Business & Technology

FBI Arrests Nigerians, Others in Massive $30 Million Romance, Retirement Account Fraud

Published

5 years agoon

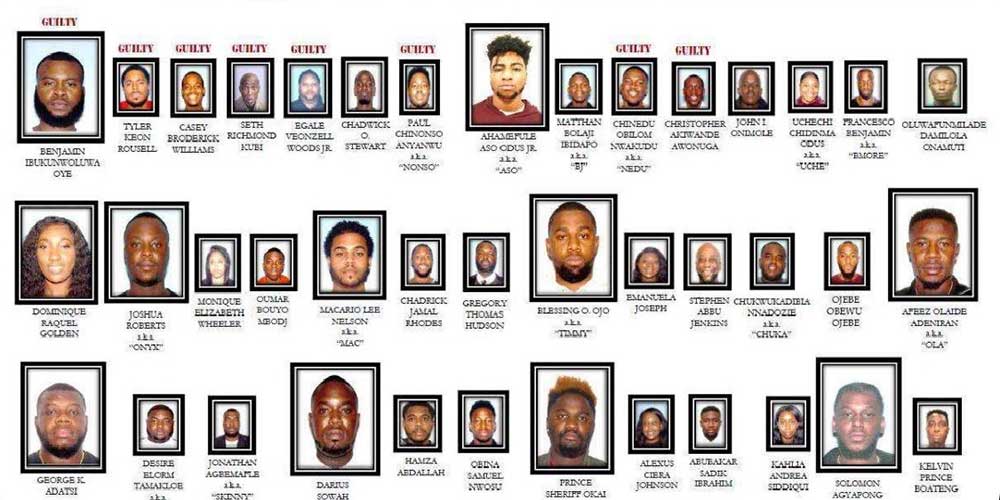

The Federal Bureau of Investigation (FBI) has announced the arrest of individuals, including Nigerians, involved in a massive $30 million computer schemes, romance scams, and retirement account fraud.

The U.S. Attorney’s Office in the Northern District of Georgia announced on Friday that its agents arrested 24 individuals for their involvement in this massive fraud that spanned many countries.

The bureau said the fraudulent activities targeted citizens, corporations, and financial institutions throughout the United States.

According to the FBI, the fraud involved business email compromise schemes, romance fraud scams, and retirement account scams, among other frauds, resulting in numerous victims losing more than $30 million.

“Fraud schemes, like the ones perpetrated and facilitated by these defendants, inflict considerable losses on citizens, companies, and the financial system,” said U.S. Attorney Byung J. “BJay” Pak.

“Some of these schemes target the elderly and often deplete the victims’ entire life savings. These arrests affirm the Department of Justice’s commitment to prosecuting those who prey on our most vulnerable citizens.”

Among those arrested was Blessing Oluwatimilehin Ojo, aka “Timmy,” 34, a Nigerian living in Nigeria who was picked up for money laundering with Darius Sowah Okang, 29 of Stone Mountain, GA, who goes by numerous aliases including Michael J. Casey, Richard Resser, Thomas Vaden, Michael Lawson, Matthew Reddington, and Michael Little.

Others include Dominique Raquel Golden, 29, of Houston, TX whose aliases include Desire Tamakloe, Mellissa Moore, Nicole Nolay, Raquel Roberts, Maria Henderson, and Raquel Golden.

George Kodjo Edem Adatsi, 36, of Atlanta, GA; Desire Elorm Tamakloe, aka “Chubby,” 25, of Smyrna, GA; Solomon Agyapong, aka “Gumpe,” 31, of Marietta, GA; Afeez Olaide Adeniran, aka “Ola,” 31, a Nigerian living in Atlanta, GA; Francesco Benjamin, aka “B-More,” 30, of Atlanta, GA.

Also arrested were Jonathan Kojo Agbemafle, aka “Skinny,” 26, of Kansas City, Missouri; Joshua Roberts, aka “Onyx,” 28, of Houston, Texas; Hamza Abdallah, aka Reggie Lewis, 30, of McDonough, Georgia; Prince Sheriff Okai, 26, of Mableton, Georgia; Kelvin Prince Boateng, 24, of Atlanta, Georgia; Monique Wheeler, 29, of Atlanta, Georgia; Matthan Bolaji Ibidapo, aka “B.J.,” 27, a Nigerian, of Colorado Springs, Colorado.

Stephen Abbu Jenkins whose aliases include “Face”, Steven Abbu Jenkins, Steven Jenkins and Steve Jenkins, 53, of Atlanta, Georgia; Kahlia Andrea Siddiqui, 28, of Chamblee, Georgia; Alexus Ciera Johnson, 26, of Mableton, Georgia; Abubakar Sadik Ibrahim, 26, of Mableton, Georgia; Emanuela Joe Joseph, 34, of Lawrenceville, Georgia; Obinna Nwosu, 26, a Nigerian, of Douglasville, Georgia; Ojebe Obewu Ojebe, 27, of Atlanta, Georgia; and Gregory Thomas Hudson, 38, of Powder Springs, Georgia, were also picked up for money laundering.

Darius Sowah Okang was also charged with one count of bank fraud, and one count of aggravated identity theft. The indictment alleged that Okang created a bank account in a retirement scam victim’s name, which was then used to deposit approximately $288,000 in funds fraudulently withdrawn from the victim’s retirement account.

Afeez Olaide Adeniran and Blessing Ojo are also charged with wire fraud. The indictment alleged that Adeniran defrauded a homebuyer of $40,000 intended for a real estate transaction. The indictment alleged that due to a computer intrusion and false invoicing scam, Ojo caused a media company in California to send payments totaling $89,140 to a bank account controlled by one of the defendants. In total, the victim sent $646,840, as a result of the fraud.

Meanwhile, two related cases charging additional defendants with various counts of bank fraud, aggravated identity theft, money laundering, and conspiracies to commit these offenses are currently pending in federal court in Atlanta.

These defendants in those cases include Benjamin Ibukunoluwa Oye, 26, of Sandy Springs, Georgia; Tyler Keon Roussell, 25, of Atlanta, Georgia; Christopher Akinwande Awonuga, 27, of Fayetteville, Georgia; Casey Broderick Williams, 26, of Covington, Georgia; Macario Lee Nelson, a/k/a “Mac,” 24, of Atlanta, Georgia; Chadrick Jamal Rhodes, 28, of Atlanta, Georgia; Chadwick Osbourne Stewart, 40, of Atlanta, Georgia and Oumar Bouyo Mbodj, 28, of Kennesaw, Georgia.

Others include Seth Appiah Kubi, 60, of Dacula, Georgia; Ahamefule Aso Odus, 27, of Atlanta, Georgia; Paul Chinonso Anyanwu, 27, of Hampton, Georgia; Egale Veonzell Woods, Jr., 41, of East Point, Georgia; Chineda Obilom Nwakadu, 25, of McDonough, Georgia; Chukwukadibia Ikechukwu Nnadozie, aka “Chuka,” and Michael McCord, 27, of Fayetteville, Georgia; Uchechi Chidimma Odus, a/k/a “Uche,” 23, of Atlanta, Georgia; John Ifeoluwa Onimole, 27, of Powder Springs, Georgia; and Oluwafunmilade Onamuti, a/k/a Mathew Kelvin, 26, of Duluth, Georgia.

The FBI thanked all those who helped make this arrest possible.

“The FBI would like to thank our numerous federal, state and local law enforcement partners who helped make these arrests possible,” said Chris Hacker, Special Agent in Charge of FBI Atlanta.

“There is no way we can make the victims of these schemes, many who have lost their life savings, whole again. Hopefully the arrests and pending prosecutions will at least give them solace that someone is being held accountable for their losses.”

“An important mission of the Office of Inspector General is to investigate allegations of fraud relating to employee benefit plans. We will continue to work with our law enforcement partners to investigate these types of allegations,” stated Rafiq Ahmad, Special Agent-in-Charge, Atlanta Region, U.S. Department of Labor Office of Inspector General.

“This investigation and subsequent arrests is due to the level of cooperation and information sharing by all law enforcement partners involved,” said Steven R. Baisel, Special Agent in Charge of the U.S. Secret Service, Atlanta Field Office. “The Secret Service will continue to collaborate with the U.S. Attorney’s Office and our partners to safeguard the nation’s critical financial infrastructure and the people in our communities.”

“No one deserves to have their hard-earned money stolen from them, so identifying and arresting these defendants makes everyone in the community safer,” said acting Special Agent in Charge Robert Hammer, who oversees Homeland Security Investigations (HSI) operations in Georgia and Alabama. “Foreign nationals arrested in this scheme will be placed into removal proceedings upon completion of their criminal sentence.”

The Nigerian Community Staff posts and edits content on The Nigerian Community website

Business & Technology

UK Nursing Council Probes 512 Nigerian Nurses Over Fraudulent Exam Results

Published

2 years agoon

May 5, 2023

The Nursing and Midwifery Council of the United Kingdom has notified 512 registered nurses that they are being probed for illegally obtaining their registration.

The council said Friday that there is a high probability that the Nigerians committed fraud in obtaining their credentials.

According to the statement by the Council, to make sure internationally educated professionals have the right knowledge and skills to provide high-quality care in the UK, they must take a two-part test of competence before joining our register: a computer-based test (CBT) usually sat in their home country, and a practical test (OSCE) in the UK.

An organization called Pearson VUE runs the CBT program on the NMC’s behalf.

The Council said they were recently alerted to anomalous data “at one of its third-party CBT test centers in Ibadan, Nigeria. Pearson VUE stopped testing at this center immediately.”

“A total of 512 people on our register (around five percent of all the professionals on our register who qualified in Nigeria) took their CBT at this test center. We’re writing to them to set out what’s happened, and to tell them we’re opening cases to determine whether or not they gained fraudulent or incorrect entry to the register.

“More people have applied to join the register but are not yet on it, therefore they can’t practice as a nurse or midwife. We’ve paused their applications. We’re writing to these applicants to ask them to retake the test, and to request more information that we’ll use to make a final decision about their application.

“Our paramount concern is to maintain the integrity of the register to protect the public. At the same time, it’s critical we approach any investigations about individuals objectively and transparently, avoiding any unfair discrimination,” the Council said.

The Council said Pearson VUE has reviewed all data relating to the NMC’s CBT from every test site globally, and there is no evidence of similar activity at any other site.

According to Andrea Sutcliffe, NMC Chief Executive and Registrar, “data from one test site in Nigeria is unusual and concerning. We have regulatory processes which we will now follow, and if necessary, we can refuse registration or remove people from our register, to protect the public and people who use health and care services.

“We know the public and people who use services may find this worrying. This affects just over 500 out of the 771,445 professionals on our register. They will all have passed the practical test in this country before they were accepted onto the register and to date no concerns have been referred to us about their fitness to practice.

“We should remember that thousands of nurses and midwives who were educated overseas have safely joined our register recently and continue to provide safe, effective and kind care across the UK.”

The NMC uses a Test of Competence (ToC) to assess the skills and knowledge of people applying to join our register from overseas.

This has two main parts: a multiple-choice computer-based test known as the CBT which applicants usually sit in their home country; and a practical test known as the OSCE which people take in the UK.

The CBT is split into two parts: Part A covers numeracy, and Part B covers clinical questions for nursing or midwifery.

A company called Pearson VUE runs the CBT. They’ve been the NMC’s test provider since 2014, when we introduced the test.

A total of 1,970 candidates took their CBT at this center, of whom 512 are on the NMC register.

Pearson VUE immediately suspended tests at the Ibadan center. The NMC has since been working urgently with them to examine data and evidence about this. The NMC is also scrutinizing the full applications of those who have joined the register.

The NMC said it is writing to some applicants and professionals on their register to set out what’s happened and what it means for them. The NMC is also opening some cases to determine whether individuals gained fraudulent or incorrect entry to the register.

Sutcliffe said the NMC is giving the nurses involved the option to retake the test “and our test provider is covering the candidate exam fee costs.

“The NMC can’t make people resit – it will be their decision. If somebody does retake and passes, it won’t guarantee that they’ll gain entry to the register or be able to stay on it, but it will form part of the information the NMC will use to make a final decision.

“The NMC will consider the need for interim orders on an evidenced basis as part of each case we’re opening to determine whether or not individuals gained incorrect or fraudulent entry to the register.

“We’re looking into concerns and if necessary to manage risk, we can apply to panels to restrict individuals’ practice.”

The NMC confirmed that at this stage, “no fitness to practice concerns have been raised about anyone on the register in this group. But clearly, if someone has gained entry to the register incorrectly or fraudulently then the NMC will need to take action.

She said the NMC is approaching investigations about individuals objectively and transparently, avoiding any unfair discrimination.

“It has not yet made any determinations about individuals. Unless the NMC decide there is sufficient evidence to seek an interim suspension order, individuals will be able to continue to work,” she added.

Business & Technology

Notorious Nigerian Fraudster Hushpuppi Gets 11 Years in Jail

Published

2 years agoon

November 8, 2022

Notorious Nigerian fraudster and former Instagram influencer Ramon Abbas, also known as Hushpuppi, has been given an 11-year jail sentence for his crimes by a California judge.

Authorities in California said Abbas was the head of an international fraud syndicate.

Abbas was also ordered to pay nearly two million dollars in restitution to two of his victims for his crime.

Known for flaunting his lavish lifestyle on Instagram before he was busted by U.S. authorities two years ago, Abbas has been in a U.S. jail since.

Don Always, the assistant director in charge of the FBI’s Los Angeles field office, Abbas was “one of the most prolific money launderers in the world”.

“Abbas leveraged his social media platforms… to gain notoriety and to brag about the immense wealth he acquired by conducting business email compromise scams, online bank heists, and other cyber-enabled fraud that financially ruined scores of victims and provided assistance to the North Korean regime,” Mr. Alway said in a court document this week.

Abbas pleaded guilty to several crimes, including money laundering, last year, including attempting to steal more than $1.1 million from individuals trying to fund a new children’s school in Qatar.

He also admitted to other crimes, including “several other cyber and business email compromise schemes that cumulatively caused more than $24 million in losses”.

Business & Technology

Owner of Company Appointed to Issue Nigerian Visas Worldwide Indicted for Fraud

Published

5 years agoon

April 8, 2020

Until a few years ago, if you needed a visa to travel to Nigeria, you did what you would do if you were looking for a visa to most countries – you went to the Embassy or Consulate in your home country.

That is until someone in Nigeria’s interior ministry realized that visa issuance was a way to make huge sums of money.

Today if you need a Nigerian visa, you went through a private company owned by Mahmood Ahmadu. The company is Online Integrated Solutions (OIS) and the Nigerian government appointed them as the sole entity with the authority to issue Nigerian visas worldwide.

Earlier today, The Nigerian Community learnt the Nigerian government-appointed company is facing charges of fraud and money laundering in Nigeria.

According to media reports, Mr. Ahmadu along with three others including former Nigerian Interior Minister Abba Moro, is facing charges of fraud and breach of public procurement laws.

All those charged including Mr. Ahmadu have denied all wrongdoing.

Online Integrated Solutions (OIS), states on its website that it is present and conducting business on behalf of the Nigerian Government in 25 major cities across the world in Nigeria, China, Lebanon, UAE, Malaysia, Italy, Netherlands, South Africa, USA , France, Germany, UK, India, and Canada.

The company prides itself as “a specialist Nigerian visa and passport application agency” in partnership with diplomatic missions across the world to “expedite hitch-free travel” to global destinations.

The company makes millions of dollars every year working with the Nigerian government to issue visas.

The Trend of Presiding Over Nigeria from Europe Continues with Tinubu

UK Nursing Council Probes 512 Nigerian Nurses Over Fraudulent Exam Results

Nigerian Politician, Wife Jailed in London for Illegal Kidney Plot

Shock Poll! Majority of Nigerians Love Donald Trump, Give the U.S. President Thumbs Up

Urualla Action Women Organization Launches in Houston, Texas

FBI Arrests Nigerians, Others in Massive $30 Million Romance, Retirement Account Fraud

Trending

-

Other News6 years ago

Other News6 years agoShock Poll! Majority of Nigerians Love Donald Trump, Give the U.S. President Thumbs Up

-

Community Events6 years ago

Community Events6 years agoUrualla Action Women Organization Launches in Houston, Texas

-

Community Events6 years ago

Community Events6 years agoFestival Organizers Invite Houstonians to Celebrate Nigeria’s Independence

-

Entertainment & Fashion6 years ago

Entertainment & Fashion6 years agoMeet Ego Nwodim, the Nigerian-American taking Hollywood by Storm

-

Community Events5 years ago

Community Events5 years agoNigerian Consulate to Conduct Nigerian E-Passport Intervention in Houston, TX

-

Community Events6 years ago

Community Events6 years agoNigeria Cultural Parade Hopes to Educate Americans about Nigeria

-

Community Events6 years ago

Community Events6 years agoCultural Dance, Gele Contest, Products Exhibition at Nigerian Day

-

Community Events6 years ago

Community Events6 years agoHouston Weather Dampens Enthusiasm at Nigeria Cultural Parade