Business & Technology

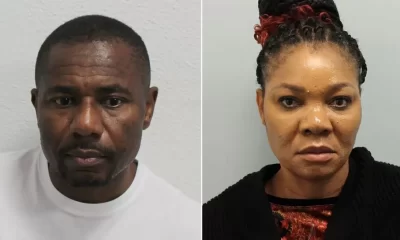

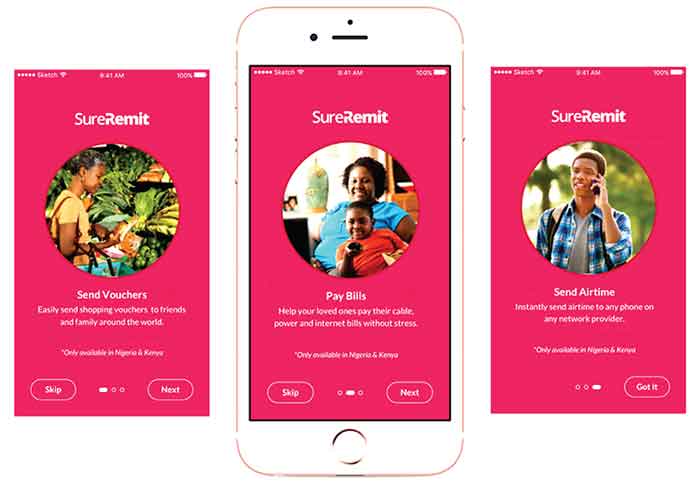

SureRemit is Changing the Way Nigerians Abroad Help Their Families Back Home

Published

6 years agoon

As a Nigerian living in United States, I love to help my family back home. I send money home to help them buy food, pay bills, pay school fees, buy medications, top off airtime, and much more.

I’m sure you do too.

There is just one problem – high fees. Currently when we wire funds to our families through money transfer services such as Western Union and MoneyGram, or through banks, we pay up to 10% in fees.

That is a stiff price to pay just to help our families.

Nigeria based SureRemit has stepped in to help. If you are not familiar with SureRemit, don’t fret. You are not alone.

SureRemit describes itself as “an ecosystem of merchants for global non-merchant remittances.” That is a fancy way of saying they make it easier and cheaper, for you to help your families back home meet their everyday needs.

The company, backed by titans of finance and technology, has been around for a number of years although they are just now letting all of us know of their existence.

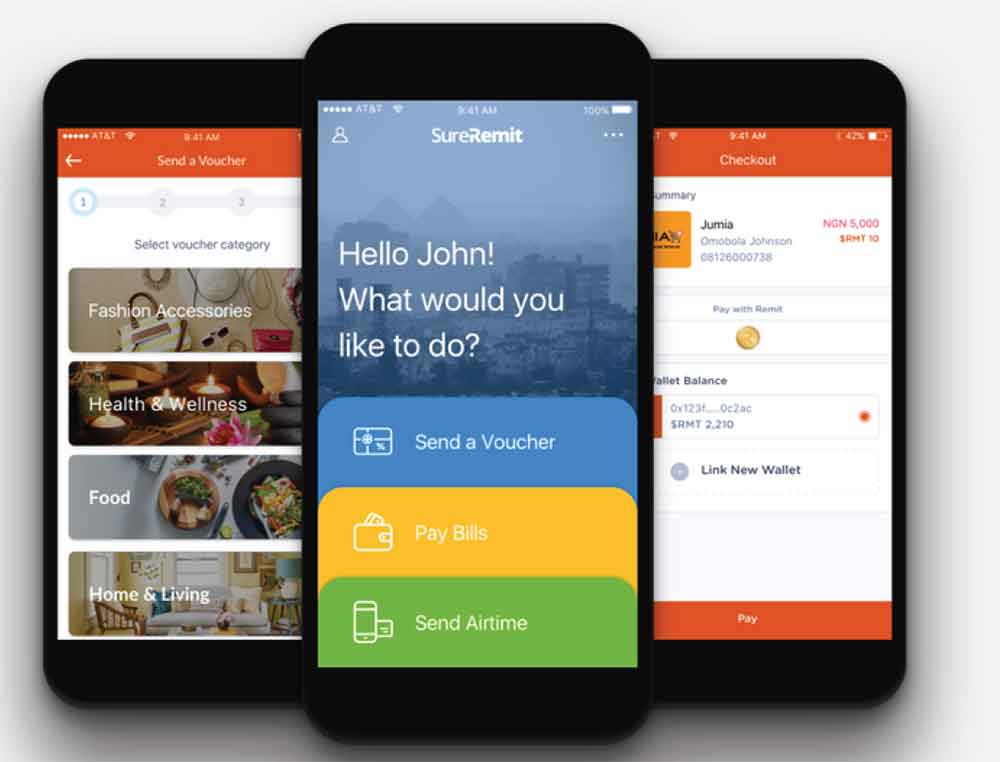

SureRemit is different from traditional money transfer companies. Firstly, they are not a money wire service, meaning you do not transfer cash to your family on their platform. That removes the risk to your family who may be robbed when they pick up the money you send to them.

Secondly, SureRemit charges fees between zero and two percent. They are able to keep the fees low through blockchain technology. And the merchant, not the sender, pays the fees.

Incorporated in Mauritius, SureRemit connects their crypto product (token) which are not redeemable for cash, to a network of pre-approved merchants in Nigeria and other countries in Africa, including Kenya and Rwanda.

One of the biggest merchants on the network is Jumia, Africa’s largest ecommerce platform that sells everything from groceries to shoes, handbags and jewelries.

Using SureRemit’s app, clients can present tokens to merchants and pay for most things including utility bills, student tuition, consumer goods and more. The beauty of it is that your family gets exactly the amount you sent them and uses that fund only for the intended purpose.

No more excuses.

‘SureRemit is different from traditional money transfer companies. Firstly, they are not a money wire service, meaning you do not transfer cash to your family on their platform. That removes the risk to your family who may be robbed when they pick up the money you send to them.’

According to Olawole Samule-Biyi, co-founder of SureRemit, “there will be no purchase or transfer fees for the token above face value.” He said his company generates revenue by charging businesses who accept these tokens.

“We’re a big channel to connecting them to the multi-billion dollar market of remittance inflows,” he told the media. “So our model is transferring costs of remittances to the merchant side away from the sender side.”

Selwijn Paehlig, SureRemit’s community manager said this week that they are expanding and adding merchants at a rapid pace.

“We are adding merchants at a fast rate. The plan is to have our services accepted everywhere,” he said.

The Nigerian Community spoke with Alex Ledsinger, SureRemit’s Country Ambassador during the recent Nigerian Day Festival in Houston, TX and he told us that his company’s mobile application is designed to let any Nigerian “send value including clothes, pay bills, groceries, and more, to their loved ones across country borders faster and cheaper.”

The Nigerian Community spoke with Alex Ledsinger, SureRemit’s Country Ambassador during the recent Nigerian Day Festival in Houston, TX and he told us that his company’s mobile application is designed to let any Nigerian “send value including clothes, pay bills, groceries, and more, to their loved ones across country borders faster and cheaper.”

“With SureRemit, you cut out shipping costs, delivery, and excessive transfer charges,” Ledsinger said.

According to recent World Bank remittances data, about 250 million immigrants in the world send over $600bn to support their friends and families back home every year and over 40% of these remittances are intended for specific uses like food, clothing, medicine, school fees or utility bill payments.

The question isn’t whether you will help and support your family back home, the question is how much will it cost you to do so? Using SureRemit’s platform, the answer could well be – zero.

Felix Ofiwe is the Publisher and Editor of The Nigerian Community, a community and news website about Nigerians in diaspora.

Business & Technology

UK Nursing Council Probes 512 Nigerian Nurses Over Fraudulent Exam Results

Published

1 year agoon

May 5, 2023

The Nursing and Midwifery Council of the United Kingdom has notified 512 registered nurses that they are being probed for illegally obtaining their registration.

The council said Friday that there is a high probability that the Nigerians committed fraud in obtaining their credentials.

According to the statement by the Council, to make sure internationally educated professionals have the right knowledge and skills to provide high-quality care in the UK, they must take a two-part test of competence before joining our register: a computer-based test (CBT) usually sat in their home country, and a practical test (OSCE) in the UK.

An organization called Pearson VUE runs the CBT program on the NMC’s behalf.

The Council said they were recently alerted to anomalous data “at one of its third-party CBT test centers in Ibadan, Nigeria. Pearson VUE stopped testing at this center immediately.”

“A total of 512 people on our register (around five percent of all the professionals on our register who qualified in Nigeria) took their CBT at this test center. We’re writing to them to set out what’s happened, and to tell them we’re opening cases to determine whether or not they gained fraudulent or incorrect entry to the register.

“More people have applied to join the register but are not yet on it, therefore they can’t practice as a nurse or midwife. We’ve paused their applications. We’re writing to these applicants to ask them to retake the test, and to request more information that we’ll use to make a final decision about their application.

“Our paramount concern is to maintain the integrity of the register to protect the public. At the same time, it’s critical we approach any investigations about individuals objectively and transparently, avoiding any unfair discrimination,” the Council said.

The Council said Pearson VUE has reviewed all data relating to the NMC’s CBT from every test site globally, and there is no evidence of similar activity at any other site.

According to Andrea Sutcliffe, NMC Chief Executive and Registrar, “data from one test site in Nigeria is unusual and concerning. We have regulatory processes which we will now follow, and if necessary, we can refuse registration or remove people from our register, to protect the public and people who use health and care services.

“We know the public and people who use services may find this worrying. This affects just over 500 out of the 771,445 professionals on our register. They will all have passed the practical test in this country before they were accepted onto the register and to date no concerns have been referred to us about their fitness to practice.

“We should remember that thousands of nurses and midwives who were educated overseas have safely joined our register recently and continue to provide safe, effective and kind care across the UK.”

The NMC uses a Test of Competence (ToC) to assess the skills and knowledge of people applying to join our register from overseas.

This has two main parts: a multiple-choice computer-based test known as the CBT which applicants usually sit in their home country; and a practical test known as the OSCE which people take in the UK.

The CBT is split into two parts: Part A covers numeracy, and Part B covers clinical questions for nursing or midwifery.

A company called Pearson VUE runs the CBT. They’ve been the NMC’s test provider since 2014, when we introduced the test.

A total of 1,970 candidates took their CBT at this center, of whom 512 are on the NMC register.

Pearson VUE immediately suspended tests at the Ibadan center. The NMC has since been working urgently with them to examine data and evidence about this. The NMC is also scrutinizing the full applications of those who have joined the register.

The NMC said it is writing to some applicants and professionals on their register to set out what’s happened and what it means for them. The NMC is also opening some cases to determine whether individuals gained fraudulent or incorrect entry to the register.

Sutcliffe said the NMC is giving the nurses involved the option to retake the test “and our test provider is covering the candidate exam fee costs.

“The NMC can’t make people resit – it will be their decision. If somebody does retake and passes, it won’t guarantee that they’ll gain entry to the register or be able to stay on it, but it will form part of the information the NMC will use to make a final decision.

“The NMC will consider the need for interim orders on an evidenced basis as part of each case we’re opening to determine whether or not individuals gained incorrect or fraudulent entry to the register.

“We’re looking into concerns and if necessary to manage risk, we can apply to panels to restrict individuals’ practice.”

The NMC confirmed that at this stage, “no fitness to practice concerns have been raised about anyone on the register in this group. But clearly, if someone has gained entry to the register incorrectly or fraudulently then the NMC will need to take action.

She said the NMC is approaching investigations about individuals objectively and transparently, avoiding any unfair discrimination.

“It has not yet made any determinations about individuals. Unless the NMC decide there is sufficient evidence to seek an interim suspension order, individuals will be able to continue to work,” she added.

Business & Technology

Notorious Nigerian Fraudster Hushpuppi Gets 11 Years in Jail

Published

2 years agoon

November 8, 2022

Notorious Nigerian fraudster and former Instagram influencer Ramon Abbas, also known as Hushpuppi, has been given an 11-year jail sentence for his crimes by a California judge.

Authorities in California said Abbas was the head of an international fraud syndicate.

Abbas was also ordered to pay nearly two million dollars in restitution to two of his victims for his crime.

Known for flaunting his lavish lifestyle on Instagram before he was busted by U.S. authorities two years ago, Abbas has been in a U.S. jail since.

Don Always, the assistant director in charge of the FBI’s Los Angeles field office, Abbas was “one of the most prolific money launderers in the world”.

“Abbas leveraged his social media platforms… to gain notoriety and to brag about the immense wealth he acquired by conducting business email compromise scams, online bank heists, and other cyber-enabled fraud that financially ruined scores of victims and provided assistance to the North Korean regime,” Mr. Alway said in a court document this week.

Abbas pleaded guilty to several crimes, including money laundering, last year, including attempting to steal more than $1.1 million from individuals trying to fund a new children’s school in Qatar.

He also admitted to other crimes, including “several other cyber and business email compromise schemes that cumulatively caused more than $24 million in losses”.

Business & Technology

Owner of Company Appointed to Issue Nigerian Visas Worldwide Indicted for Fraud

Published

4 years agoon

April 8, 2020

Until a few years ago, if you needed a visa to travel to Nigeria, you did what you would do if you were looking for a visa to most countries – you went to the Embassy or Consulate in your home country.

That is until someone in Nigeria’s interior ministry realized that visa issuance was a way to make huge sums of money.

Today if you need a Nigerian visa, you went through a private company owned by Mahmood Ahmadu. The company is Online Integrated Solutions (OIS) and the Nigerian government appointed them as the sole entity with the authority to issue Nigerian visas worldwide.

Earlier today, The Nigerian Community learnt the Nigerian government-appointed company is facing charges of fraud and money laundering in Nigeria.

According to media reports, Mr. Ahmadu along with three others including former Nigerian Interior Minister Abba Moro, is facing charges of fraud and breach of public procurement laws.

All those charged including Mr. Ahmadu have denied all wrongdoing.

Online Integrated Solutions (OIS), states on its website that it is present and conducting business on behalf of the Nigerian Government in 25 major cities across the world in Nigeria, China, Lebanon, UAE, Malaysia, Italy, Netherlands, South Africa, USA , France, Germany, UK, India, and Canada.

The company prides itself as “a specialist Nigerian visa and passport application agency” in partnership with diplomatic missions across the world to “expedite hitch-free travel” to global destinations.

The company makes millions of dollars every year working with the Nigerian government to issue visas.

The Trend of Presiding Over Nigeria from Europe Continues with Tinubu

UK Nursing Council Probes 512 Nigerian Nurses Over Fraudulent Exam Results

Nigerian Politician, Wife Jailed in London for Illegal Kidney Plot

Shock Poll! Majority of Nigerians Love Donald Trump, Give the U.S. President Thumbs Up

Urualla Action Women Organization Launches in Houston, Texas

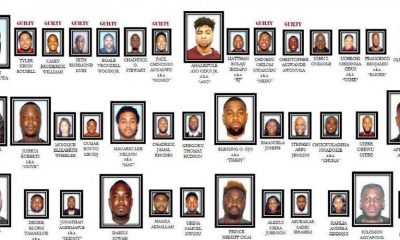

FBI Arrests Nigerians, Others in Massive $30 Million Romance, Retirement Account Fraud

Trending

-

Other News6 years ago

Other News6 years agoShock Poll! Majority of Nigerians Love Donald Trump, Give the U.S. President Thumbs Up

-

Community Events6 years ago

Community Events6 years agoUrualla Action Women Organization Launches in Houston, Texas

-

Business & Technology4 years ago

Business & Technology4 years agoFBI Arrests Nigerians, Others in Massive $30 Million Romance, Retirement Account Fraud

-

Community Events6 years ago

Community Events6 years agoFestival Organizers Invite Houstonians to Celebrate Nigeria’s Independence

-

Entertainment & Fashion6 years ago

Entertainment & Fashion6 years agoMeet Ego Nwodim, the Nigerian-American taking Hollywood by Storm

-

Community Events4 years ago

Community Events4 years agoNigerian Consulate to Conduct Nigerian E-Passport Intervention in Houston, TX

-

Community Events6 years ago

Community Events6 years agoNigeria Cultural Parade Hopes to Educate Americans about Nigeria

-

Community Events6 years ago

Community Events6 years agoCultural Dance, Gele Contest, Products Exhibition at Nigerian Day